3D Secure

Keep track of ACH Payments While Improving Accuracy of Your Bookkeeping Data

- Visa Secure (formerly Verified by Visa)

- Mastercard SecureCode

- Discover BuyProtect

- American Express SafeKey

- J/Secure™

By weaving this authentication step into your checkout flow through Instant Accept, you create a smoother, safer experience—both for you and for the people you serve.

How 3D Secure Works with Instant Accept

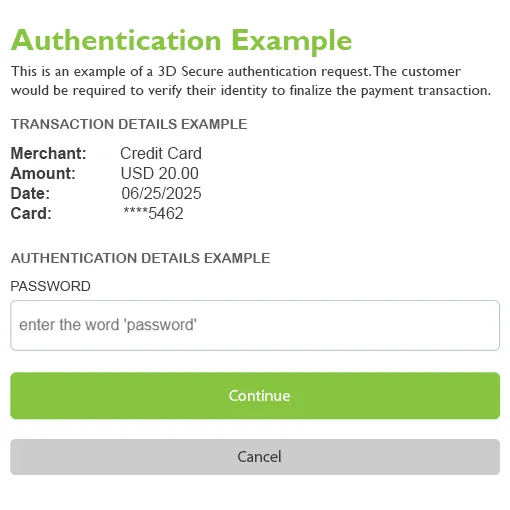

When a cardholder checks out, 3D Secure pops up an extra verification screen—often a one-time passcode or biometric approval. Here’s how Instant Accept integrates it without slowing things down:

- Seamless API call: Your checkout triggers a 3D Secure request in real time.

- Dynamic challenge flow: Based on the card issuer’s risk assessment, customers may see a simple “approve” button or enter a code sent to their phone.

- Instant confirmation: Once authenticated, funds flow into your accounting system, eliminating duplicate entries.

Benefits of 3D Secure Authentication

Fraud reduction

Verified cardholders mean fewer chargebacks.

Higher approval rates

Banks favor authenticated transactions, so you get paid more reliably.

Improved customer confidence

Shoppers feel safer when they see extra protection at checkout.

Practical Examples

Below are a few scenarios where merchants see immediate wins by enabling 3D Secure:

- Subscription renewals: A membership site cuts down on declined cards by 30% after adding 3D Secure.

- High-value purchases: Electronics retailers report fewer fraud attempts when the extra check is in place.

- Cross-border sales: International orders face more scrutiny—3D Secure bridges trust when shipping overseas.

For a deeper dive into implementation details and code samples, check out our Authentication Guide.

Getting Started with 3D Secure

Below are a few scenarios where merchants see immediate wins by enabling 3D Secure:

- Enable the feature: Toggle 3D Secure in your dashboard settings.

- Test your flow: Use our sandbox environment to simulate various challenge scenarios.

- Go live: Switch to production mode—and watch fraud rates drop.

Each step includes sample API calls and response logs so your developers can move fast without guesswork.

Ready to Secure Every Transaction?

Feel confident knowing every card swipe and online purchase passes through a proven authentication layer. Enable 3D Secure today within your Instant Accept account and start seeing fewer disputes, higher approvals, and shoppers who trust you more.

Sign up for a free demo or contact our support team to learn how easy it is to turn on 3D Secure and elevate your payment security.